Automated Invoice Processing

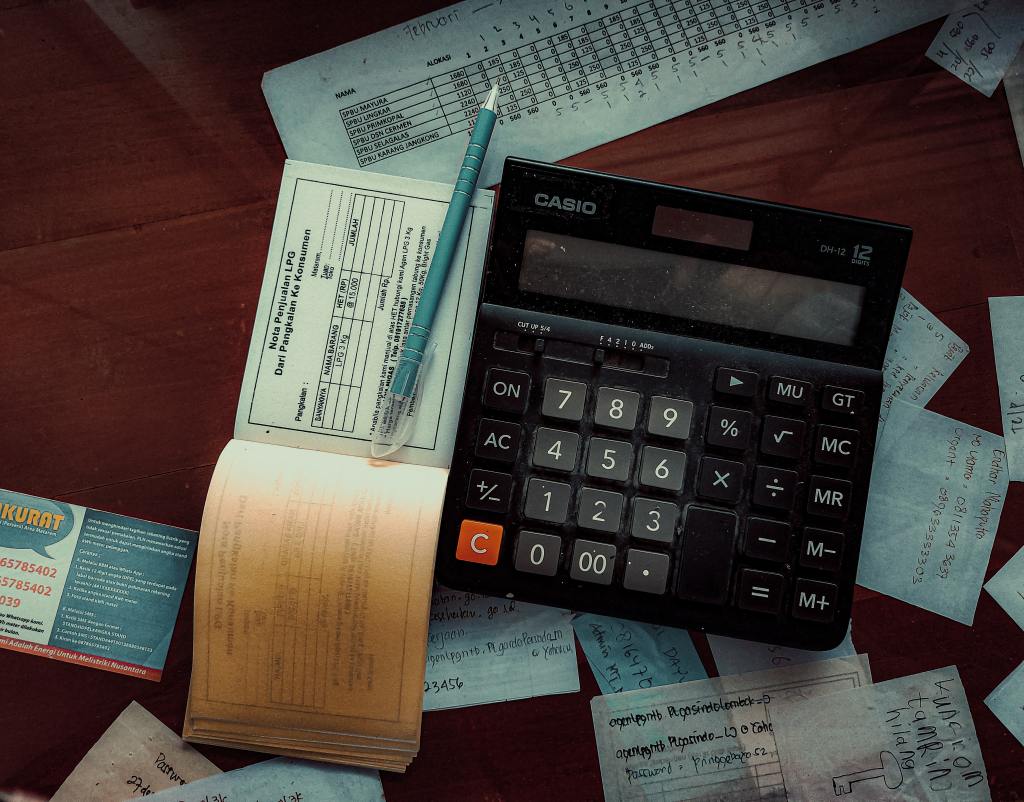

Accounts payable is a crucial component of any organization’s financial operations. It involves managing and tracking the money owed to vendors and suppliers, as well as ensuring timely and accurate payment. However, manually processing invoices and managing the accounts payable process can be time-consuming, error-prone, and ultimately costly. Fortunately, process automation technologies can help streamline and optimize accounts payable workflows, saving time, reducing errors, and improving overall financial performance. In this article, we’ll explore five quick implementations of accounts payable automation that can help organizations enhance their operations and achieve greater efficiency.

Manual invoice processing is a tedious and time-consuming task that often results in errors and delays. By automating the process, companies can streamline the AP process and reduce the risk of errors, while also improving visibility and control over cash flow.

Here are five examples of automated invoice processing that can save you time:

- Optical Character Recognition (OCR): OCR technology can read and capture data from scanned paper invoices and convert it into digital data, eliminating the need for manual data entry. This can significantly reduce the time required to process invoices while also improving accuracy.

- Electronic Data Interchange (EDI): EDI is a standardized electronic format for exchanging business documents, including invoices. By automating the EDI process, invoices can be exchanged between trading partners seamlessly and without the need for manual intervention.

- Automated Invoice Matching: Invoice matching is the process of matching the invoice with the purchase order and receipt of goods or services. By automating this process, companies can ensure that all invoices are matched correctly, reducing the risk of errors and discrepancies.

- Automated Approval Workflow: Implementing an automated approval workflow for invoices can reduce the time required for approvals and improve control over the process. By setting up predefined rules for invoice approval based on factors such as amount or supplier, invoices can be automatically routed for approval, reducing the need for manual intervention.

- Automated Payment Processing: Automated payment processing can streamline the payment process by automatically generating payment files, processing payments, and updating the accounting system. This can save time and reduce errors associated with manual payment processing.

Implementing automated invoice processing can lead to significant time savings and reduce errors in the AP process. By utilizing OCR, EDI, automated invoice matching, automated approval workflow, and automated payment processing, companies can achieve greater efficiency and control over their AP process.